Whilst the world has suffered through Covid-19 for the past two years, ecommerce has enjoyed a huge boom.

In the UK, as we now learn to live with Covid-19 it seems that the Pandemic-Ecommerce Bubble has burst which is creating a new set of challenges in 2022. Some of these challenges are a result of the Pandemic-Ecommerce Bubble/Boom and others are new, but no less important.

The number of online retailers has increased over the past two years. Whilst some traditional businesses were forced online to continue trading, many retailers were newly created and took advantage of drop-shipping to meet the increased online sales demand. Some of the new competition may fade and disappear, but there are no signs that competition will return to the levels prior to February 2020.

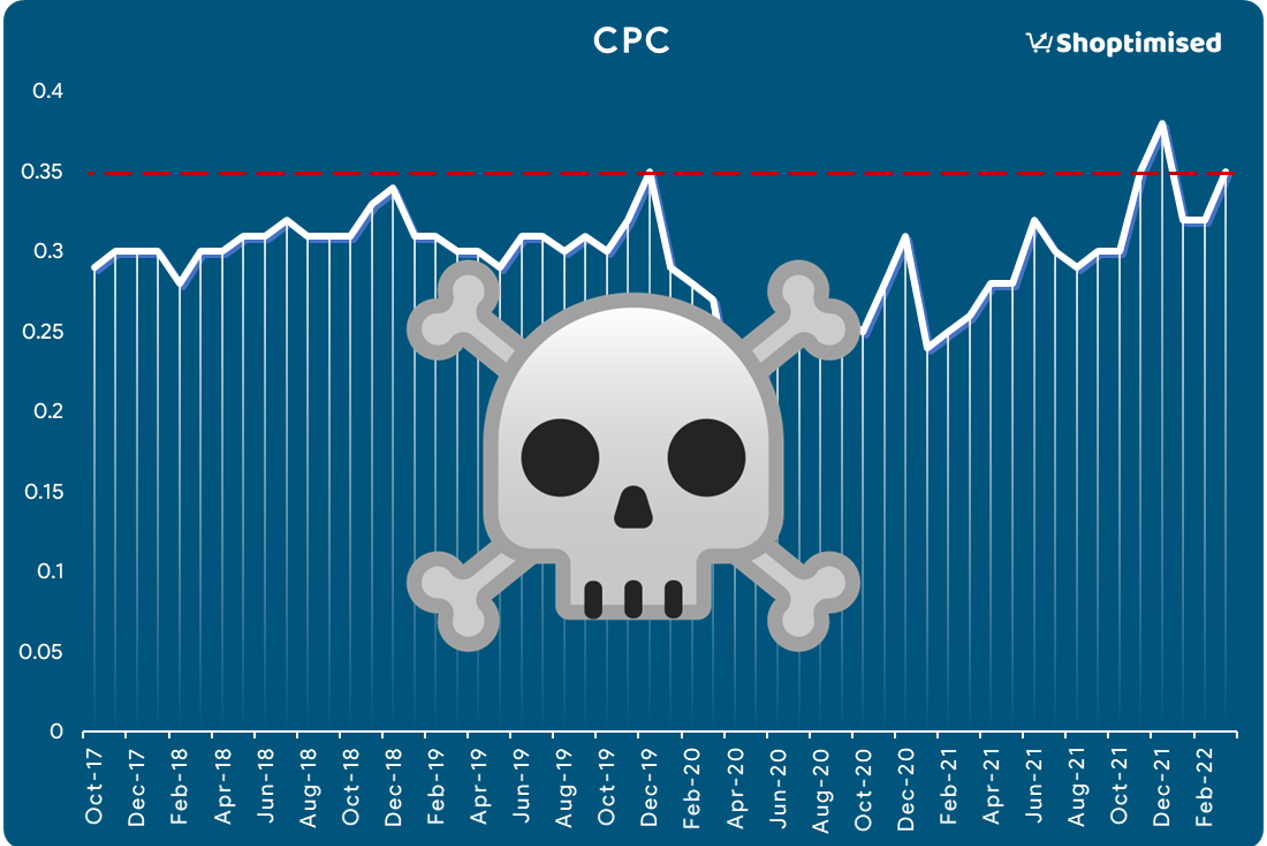

Cost per Clicks so far during March 2022 are at their 3rd highest level since we started recording in October 2017. The current Cost per Click is on par with peak trading months (November & December).

Whilst CPCs dropped earlier in the Pandemic, they spiked in November and December 2021 as expected, but the spike so far in March is not common.

When we break down Shopping Sub-Types and compare March against December 2019, we can see Smart Shopping and Performance Max have reduced but Standard Shopping has increased.

One question that is difficult to answer is whether this is due to manual intervention within Standard Shopping where CPCs can be controlled or is this happening as a result of automation from Smart and/or P.Max?

To understand this better we needed to know how many Standard Shopping campaigns are truly under manual management compared to how many are letting Google’s Target ROAS or Maximize Clicks assign the bids or Enhanced CPC to a lesser degree.

Whilst Manual CPC is increasing, the largest CPCs are being driven from having Target ROAS set up within Standard Shopping campaigns.

Percentage of Spend Via Each Target Setting Within Standard Shopping

Despite it reducing, the majority of budget is still being spent on Target ROAS Standard Shopping campaigns. Based on these figures, it does appear that automation is playing a very large part in the rapid increase of CPCs.

Budgets are still at very high levels with many trying to increase them further. One of the major draw backs with Google's automation is when trying to scale and increase your budget. If you try and increase your budget too much and too quickly, Google quickly spends that budget with greatly inflated CPCs. If your plan is to increase budget, do this gradually with smaller increments whilst ensuring the CPC is not spiking.

In January 2022, the cost of living hit a 30 year high. Energy, fuel and food prices surged by 5.5% in the 12 months up until January and are expected to climb above 7% this year with some fearing that figure could move above 8.5%. With average pay not able to keep up with the rate inflation is increasing this inevitably means, consumers have less to spend. With further increases to come, this will only get harder.

- Average gas and electricity bills are rising by £693 a year from April

- In April, companies, workers and the self-employed will start paying 1.25p more in the pound in National Insurance contributions under the Health and Social Care Levy. Although, the threshold has recently been increased.

- Rising interest rates will make mortgage payments higher for some homeowners

- TV and broadband prices are also due to increase

Putting aside the tragic & completely unjustified loss of life that Russia's war on Ukraine is causing, it's also worsening the rise of the cost of living situation according to a report by the Resolution Foundation. "The crisis in Ukraine has increased both the scale of price rises, but also the degree of uncertainty about their levels and duration".

The increased costs for energy, fuel and transport mean retailers are increasing their prices and passing that onto consumers. UK retailer Next, has already stated that it’s prices may have to increase by up to 6% to keep pace with increasing costs.

With the rising cost of living, we are now seeing a drop in demand especially within Fast Moving Consumers Goods. As consumers continue to tighten their belts ahead of uncertain times, consumer buying will be prioritised by ‘needs’ rather than ‘wants’. This issue is further compounded by the increased competition and advertising costs.

This is having a sharp impact on ROAS in Google Shopping campaigns already. ROAS has now dropped to levels not seen since February 2019 again further highlighting a return to normal whilst spend this month is set to be on par with November 2020.

Many Google Shopping advertisers are seeing a stark drop in both revenue and spend due to their campaigns still containing higher ROAS Targets.

Whilst Revenue and Cost can be addressed by removing or lowering the campaigns Target ROAS, it won’t bring back the ROAS these campaigns were previously enjoying. Setting a Target ROAS or continuing to use a Target ROAS that is no longer achievable simply limits the amount of products Google will aim to push into Shopping Ads. You can read more about demystifying Google Shopping Target ROAS here.

Our Technical Director plotted where we would have seen growth in ecommerce if the Pandemic did not occur. As you can see, we are now back towards those levels with new challenges to face.

The Orange line below is a forecast using averages and does not factor seasonality. But, at 95% confidence intervals, we expect 95% of the time we should be in between these two thinner grey and yellow lines. This graph shows that once the pandemic took hold, confidence initially dropped to the lower confidence interval in terms of spend, then it increased with people spending more money than anticipated. We are on the decline now and we can expect to drop to where we would have been should the Pandemic have not taken place.

We can see consumers increased their online purchasing during the pandemic, with a few notable drops in October 2021, potentially waiting for Black Friday sales.

Looking back its absurd to think that every month during the pandemic was ahead of Nov 2019 in terms of revenue. Also, a possible worrying trend is that cost still has not regressed to the mean average, yet revenue has. With the increased CPC and drop in demand, ROAS is suffering across the board.

The Shares of ecommerce giant Shopify are showing an incredibly similar trend to the above further displaying that demand is at least where it was in February 2020 whilst we continue to face a very unpredictable 2022.

We asked the experts from several leading agencies about their thoughts and advice on the current climate.

1 - What are the biggest challenges in Google Ads at the moment?

Google is moving more and more towards full automation, from the continued improvement of Smart Bidding and Responsive Search ads, all the way through to fully automated campaigns like Smart Shopping (RIP) and Performance Max.

The real challenge is using these tools, alongside anything else in your arsenal, to differentiate yourself from the competition. If everyone is using fully automated campaigns - how do you stand out and drive the best possible performance?

2 - Why do you think Cost per Click is so high right now?

The world is opening up following the pandemic, which is causing a few different changes. There’s less search demand - we’re not all stuck inside any more which means that there’s more time spent socialising and less time spent in front of a screen, therefore less users engaging online. In addition to this, while most of us worked from home during the pandemic, there is a notable move to get people back into offices. This means less time avoiding work by browsing and shopping online, and more time focusing on your actual job.

This decrease in demand, combined with the fantastic results that a lot of online retailers saw during the pandemic (and wanting to match this performance, or drive growth), means that everyone wants the same size slice from an ever-decreasing pie. This means that competition is fiercer, driving up costs for everyone.

The cynic in me also believes that some of this inflation is artificial, based on a lot of changes to the machine learning based systems that Google is leaning so heavily on. If users aren’t leveraging these tools correctly, it could mean higher costs for everyone.

3 - What advice would you give your client’s considering demand is low and costs are high?

Considering demand is low and costs are high, clients need to understand exactly what PPC is worth to them. PPC should not be a loss-making exercise (unless that’s been factored into your overall business strategy) - you should understand exactly what a conversion (and therefore a click or view) is worth to the business, and optimise accordingly. Based on this, you may be able to bid more aggressively on certain keyword sets, or you may look at investing in another channel or campaign type such as Discovery or YouTube - but first of all, you need to understand the value that PPC and these other channels can provide.

4 - What is your top practical tip to improve performance in the current climate?

Ensure that you have full visibility of your performance across the board. This could mean different things to different people, but if you work with an agency, I would be challenging them on the visibility that you have. This could be anything from ensuring you’ve got a live reporting dashboard built out, or understanding brand performance versus non-brand, all the way to value-based bidding, and passing back actual revenue values into machine learning - there will always be another step on the journey to gaining full clarity.

1 - What are the biggest challenges with Google Ads at the moment?

Cookie and privacy policy updates mean we’re potentially losing visibility on many customers' user and conversion journeys.

2 - Why do you think Cost per Click is so high right now?

Increased online competition YoY as the pandemic has shifted more businesses marketing budgets to digital. Combined with automated bidding (whether this is aiming for traffic or conversions) marketers are losing more control over CPC's and the market is becoming more saturated.

In the first half of 2021, there were almost 80 new businesses created every hour, again, showcasing the trend of new, increasing competition in the marketplace.

3 - What advice would you give your client’s considering demand is low and costs are high?

Ensure your account is continuously testing assets and settings you can still control to really maximise budget efficiency.

Keeping budgets and marketing plans fluid during times of uncertainty. We’d recommend assessing areas where you’re seeing strong demand/results and allocate more budget there, e.g. certain product categories or locations. Monitoring of spend and performance should be frequent to make really agile decisions in the market as the market and demand trends change.

4 - What is your top practical tip to improve performance in the current climate?

Give campaigns the most data you can to feed the bidding algorithms. Granular segmentation is out and consolidation is in!

1 - What are the biggest challenges Google Ads at the moment?

One of the biggest challenges is the constant updates and changes to Google Ads – making it challenging for PPC professionals and their clients to keep up with the latest trends and best practices. Tracking is one of the things that is going to be changing, and the way we’re used to operating when it comes to tracking will be taken away and replaced by another method. In addition to these changes, rising CPCs are doing so in line with an increase in aggression across multiple markets. As a business, we’ve not been hugely impacted by this yet, but we’ve definitely seen evidence of it across the board, and we’re prepared for if it does start to affect us more in the future.

2 – Why do you think Cost per Click is so high right now?

Businesses, understandably, are desperate to increase sales to remain profitable, so when faced with high CPCs, are pushing aggression to drive sales. Many businesses will also be looking at performance from this time last year and comparing figures to try and match numbers, but forget that we were in the midst of a lockdown, and both businesses and consumers were operating differently.

3 - What advice would you give your client’s considering demand is low and costs are high?

A - Remember that this time last year, we were in a lockdown, so there’s no way to compare account performance like for like to last year. Businesses were doing whatever they could to survive, and consumers were spending completely differently – so there’s no way to compare the two fairly or accurately.

B - There’s been huge increases to both the cost of living, and energy and fuel prices, which has had a big impact on the way people are spending. Many people don’t have the same amounts of disposable income to spend on wants as opposed to needs.

C - Neither of the above spell out good news for businesses, but it’s important to look at alternate avenues and channels in order to stay profitable. Whilst PPC is a huge channel, right now, it might not be the best performer, and businesses can also look at how they could improve their other channels.

4 – What is your top practical tip to improve performance in the current climate?

It’s important to remain agile when it comes to your strategy. This isn’t just important internally, but it’s also important that your PPC agency are just as agile and on the same page. If something isn’t working, don’t take too long to make a decision on it, and likewise, if something is working, don’t take too long to double down on it!

1 - What are the biggest challenges Google Ads at the moment?

I’d say there are two main challenges at the moment, firstly the staggering increases in the cost of clicks year on year are putting significant pressure on advertisers. Secondly, the rapid adoption of automation has turned best practices on their head. To keep up brands and agencies are having to rapidly evolve their best practices with the ever-changing landscape to keep ahead.

2 - Why do you think the Cost per Click is so high right now?

I’d say the main reasons for this are twofold. An increase in competition with businesses moving from bricks and mortar to online due to the pandemic and secondly from the expansion of match types increasing the levels of competition in auctions. Previously advertisers had a lot of control over the queries that they matched into. With the broadening of match types, advertisers are entering more auctions than ever before, pushing up the prices of clicks.

3 - What advice would you give your client’s considering demand is low and costs are high?

I’d say brands need to be realistic, ensuring that the factor in the hike in costs into their projections firstly so there are no nasty surprises when they come to review performance later in the year. Keeping a close eye on stock will also be key to making sure they don’t over order anticipating a stellar year like 2021 and ending up with a lot of stock that can’t be sold.

4 - What is your top practical tip to improve performance in the current climate?

With CPCs on the rise, it’s going to be really important to cut our wasted spend. There are a few ways that this can be done, firstly looking at what you’re matching into and making sure it’s relevant by adding negative keywords is a great start and often overlooked. Another strategy is to focus your budgets on top performers, making sure that where you are paying more for clicks you’ve got the best chance of converting that traffic.

1 - What are the biggest challenges Google Ads at the moment?

The biggest challenge facing a lot of marketers recently is the ongoing decline in consumer confidence. With concerns regarding the economy, searchers are becoming more vigilant with their finances which subsequently, is impacting conversion rate and average order value metrics across Google Ads accounts.

Google is also making changes internally with the sunsetting of GA3 and Smart Shopping campaigns, the latter of which will be 'upgraded' to Performance Max later this year. As this new campaign type will hold dominance over the existing campaign types, any areas of strong performance obtains a risk of being cannibalised by PMax as it incorporates targeting across a broader range of channels. Our testing has shown this to be the case, with impressions plummeting across accounts following activation.

2 - Why do you think Cost per Click is so high right now?

During the pandemic, a lot of businesses who had previously maintained a minimal budget towards Google Ads capitalised on the traffic surge that occurred across various lockdowns. Even post lockdown, shoppers have become accustomed to online shopping, maintaining a larger pool of potential customers for advertisers. As the additional competition has sustained it's online presence, gaining strong ad visibility and positions has become costlier. This is also reflected in marketplace platforms such as 'Amazon' and 'Etsy', making their already intimidating impression share even more significant with their consistent growth of online sellers.

3 - What advice would you give your client’s considering demand is low and costs are high?

I'd recommend looking at the bigger picture. Setting aside budget now for use in Discovery Ads or Display Ads can result in a larger pool of potential prospects/customers later on. If budget is strained, try restricting campaigns to solely target relevant in-market audiences so your ad spend is focussed on users who have shown recent intent to purchase.

4 - What is your top practical tip to improve performance in the current climate?

Path journeys are longer than ever as users have become more 'tech savvy' across the pandemic and are more cautious with their purchases, so ensure you have campaigns dedicated for each stage of the sales funnel to accommodate the varied levels of search intent. By ignoring the early or mid-stages of your customers buying journey, you risk losing them to a competitor who hasn't. Closely monitor the impact of campaigns dedicated to the 'awareness' stage to ensure they're contributing to other campaigns/marketing channels effectively. And if they aren't, test, test and test again.

1 - What are the biggest challenges Google Ads at the moment?

We see two main challenges via search currently. Volatility feels like it’s at an all time high. This is in terms of demand, what competitors are doing and how the platform behaves in general.

Alongside this it is harder than ever to understand the changing search landscape. Multiple Google ‘features’ are promoting a lack of visibility:

· Very limited visibility on Smart Shopping searches and users

· Exact Match becoming broader in what it can match to

· Exact Match generally shrinking as a share of account spend

· Search Term reports not actually showing all search terms

· Reliance on Broad Keywords

· Reliance on Performance Max campaigns

With activity being more and more of black box it makes understanding the volatility we do see incredibly speculative.

2 - Why do you think Cost per Click is so high right now?

We see two main factors contributing to high CPCs.

In general retailers are all setting their sights and targets fairly high - many would’ve been in a position over the lockdown periods where they had record high demand but more challenges than ever when it comes to fulfilment. Whilst most marketers are targeting below the lockdown peaks - they are still under-pressure to drive sales far above what they have seen pre lockdown 2020. Where demand has dipped and meant these targets aren’t being reached we have seen retailers happy to sacrifice efficiencies and push marketing spends alongside this - it feels like many retailers are in a similar position leading to significant increases in competition and CPC.

The other factor is due to the continuing changes to Google Ads taking away control from marketers and promoting broad reaching automated campaigns. There is no longer much value in having extremely well targeted Exact Match campaigns using negatives to cut out inefficient search terms. This shift towards broad targeting and leaning on smart bidding means that overlaps between retailers in terms of what search terms they are bidding on is massively increased. We see YoY more and more less relevant competitors appearing alongside our clients via competitor insights - overall these overlaps will also be pushing CPCs.

3 - What advice would you give your clients considering demand is low and costs are high?

If we are looking at Cost as simply CPC, it can be a little misleading to look at CPC change as an indicator that marketing activity is struggling. As much as the space is more competitive, Google Ads has generally got better at driving conversions through smart bidding - where across our clients we generally do see CVR improvements for Generic and Shopping activity.

Beyond that we’re finding it extremely useful to remain flexible in what activity is targeting - where the best way to manage volatility (which is bound to continue) is to be reactive with budgets and accept over/under-pacing on single months.

4 - What is your top practical tip to improve performance in the current climate?

Play ball with Google recommendations. Quality score is seemingly becoming less important than opti score - it seems actively beneficial to have a high opti score even if some of the changes to get there seem counter-productive. For example things like avoiding pinning RSAs we see drive great results - despite the ads that google will serve being a lot less cohesive than pinned ads - there's a general sense that Google just prefers accounts with high opti score. In addition to this opti score is being used more as grounds for beta participation - where 90% is often required on current Google product betas.

1 - What are the biggest challenges with Google Ads at the moment?

At the moment the biggest challenge that we are experiencing on Google ads is an overall increase in competition and particularly a lack of ability to exercise competitive advantages in our strategy. It feels as though many of our competitors are now employing best practices in Google ads that our agency were early adopters to: Feed Optimisation with Shoptimised, CSS, Smart Target ROAS Bidding, and a Broad keyword strategy. As an agency we were very quick at recognising and adapting to these strategic advantages and drove real growth for our clients in 2020 and 2021 but it now feels that a lot more competitors are now employing these best practices, making it harder for the benefits of working with a premium Google ads agency to enunciate.

2 - Why do you think Cost per Click is so high right now?

I think we are experiencing a myriad of forces affecting the current Google ads market. In addition to lower online demand and lower consumer confidence in the light of rising energy prices and uncertainty in Eastern Europe, 2020-21 saw a record number of new businesses open in the UK. Furthermore, as previously mentioned, I think we are seeing more and more people applying Google best practices which is making Google ads targeting more efficient overall, which is driving the costs up for those of us that have been applying the same best practices over a longer term.

3 - What advice would you give your clients considering demand is low and costs are high?

From looking at the sort of clients that have recently been coming to Push for support in these tough times, we notice a theme that many are under-diversified and static in their digital strategies. It has become clear that selling the same products, through the same channels with the same marketing strategies is not going to be enough to grow your business in the next year. What worked last year is not going to work this year! This is most obvious when we look at the overall revenues of Facebook growing while the platform itself saw a decrease in monthly active users. Clearly advertisers' response to reduced sales has been to increase their ad spend on Facebook, while Facebook users themselves are moving elsewhere. Instead of relying on what has worked in the past, successful businesses will innovate and diversify their product portfolios and generate intent based search demand though top of funnel marketing on high growth platforms like YouTube and TikTok. More and more consumer time is being spent on video, and video is the biggest opportunity for good marketing agencies to enunciate their competencies. Video is an area that Push have been developing over the last year and with the growth of Video first platforms we definitely see video as being the most important growth area for our clients this year.

4 - What is your top practical tip to improve performance in the current climate?

Aside from what we've already discussed, two great areas to focus on improving are conversion rates and customer values as these two metrics will mitigate against negative market conditions and, when the market starts to look more positive, will help clients to maximise their gains.

1 - What are the biggest challenges with Google Ads at the moment?

From an advertiser’s perspective, the last couple of years have been a whirlwind - from Covid blowing YoY trend data out of the water, consumer buying habits fluctuating on a monthly basis and Google implementing a wealth of new campaign formats, It has meant that agencies have had to pivot strategies on a more regular basis than before.

I would also argue however (anecdotally perhaps!) that these challenges may not necessarily just be felt from an agency perspective. With Google facing industry backlash over the last year around data visibility (for example around a lack of data insights into performance max as well as search term visibility in general), there has been a greater cause for advertisers to diversify their paid media advertising, meaning that Google may be seeing some advertisers reduce spend on the platform.

2 - Why do you think Cost per Click is so high right now?

There are a number of reasons as to why CPC may be rising but without a shadow of a doubt COVID plays a large role in that. As mentioned, with almost monthly fluctuations in buyer habits, this would undoubtedly have an impact upon CPC’s and wider auction competition. However, in general COVID has left many businesses looking at their digital marketing efforts and in particular where they can maximise revenue - with search typically offering a fantastic way of driving up revenue figures. As a result, I would argue that as we see auctions begin to mature again, we may see CPC’s fall, but as things stand most industries are seeing spikes in competition and as such, higher CPC’s.

Thinking from an external perspective, it is also important to take into account wider economic circumstances. With cost of living increasing and individuals having to cut back spending, this will obviously in turn impact both search volumes and subsequently CPC’s.

I believe one thing businesses have to be wary of is not necessarily chasing 2020 revenue figures (which in some instances rose exponentially) with a reduced demand (taking into account the above examples).

3 - What advice would you give your clients considering demand is low and costs are high?

Transparency! It’s so crucial in times such as these to ensure that all paid advertising has clear goals and focuses and that there is clear visibility on what is and isn’t performing well. On a call with one of my clients the other day, he asked the question ‘well what’s working and what isn’t?’ and as simplistic as it may seem, this is the crux of what is important!

With costs rising and demand becoming more competitive, transparency around benchmarks have never been more crucial as well thought out KPI’s can help to ensure campaigns remain successful even during difficult times.

If businesses can be clear, transparent and open with benchmarks and targets,this allows agencies to push those key strategic drivers further - meaning we can both see better returns.

4 - What is your top practical tip to improve performance in the current climate?

As simple as it sounds, ensure that the basics are as good as they can be! No matter how many shifts we see in what is required of advertisers, the foundations largely remain the same and as important as ever. Continue testing ad quality, match types and audiences. Ensure all extensions are covered and that ads are directing users to the most relevant page. If quality scores remain strong then it always ensures that you’re competitive.

A huge challenge in Google Ads is the confluence of hypercompetition, volatile demand, and full automation. And that’s likely as true for the next 18 months as it has been for the last 18 months.

On the supply side, the technical barriers to ecommerce and acquisition have never been lower, which is helping to support a rise in entrepreneurship even as juggernauts continue concentrating markets. The result is a big squeeze, which is driving overall customer acquisition costs and unit metrics like CPC and CPM.

Meanwhile, on the demand side, we see online growth slowing as pandemic-related policies have relaxed in many markets and mobility in turn approaches pre-pandemic levels. Add recent inflation woes to the picture, and you can readily imagine why consumer volume and intent are shaky – which can be reflected in challenging conversion rates and average order values.

Some advertisers then feel caught in a situation where highly automated campaigns are most likely to deliver raw performance, yet hardest to steer in terms of true ROI – not to be confused with ROAS. My most practical and widely-applicable advice here is to cut the knot by tracking gross profit instead of revenue. This step eliminates guesswork and delivers a solid, safe growth foundation upon which you can experiment. If implementation is too challenging, a quick win would be to structure your campaigns based on margin. Generally I love the practice of bringing traditionally off-channel data into your feed and campaigns.

Firstly, we must accept the situation as it is. A unique set of circumstances have converged to create a perfect storm that none of us can control.

Reassess your KPIs and Target ROAS. This may mean you can increase revenue whilst accepting less profit. However, not every product you sell has the same margin. Grouping hundreds or thousands of products under the same Shopping Campaign with one Target ROAS is going to hold you back.

You need understand your margins better and pass this data back to Google Shopping by utilising the Cost of Goods Sold attribute in your product feeds. You can then lower your Target ROAS on your higher margin products.

Watch the market more closely, are you still price competitive or are your competitors discounting already? You may need to utilise price comparison data more regularly in order to achieve this.

Discount tactically, don’t throw around blanket discounts. Make sure you have enough margin in your products or that your promotions focus on increasing the basket size such as buy one, get X% off the 2nd or 3rd product purchased.

Try not to panic, it’s easier said then done we know! If you have been working with an in-house marketer or an agency for a while and things quickly take a turn for the worst, have confidence this is not their doing and that they are best placed to help you move forward.

Don’t over optimise. Every optimisation takes time and quite often it can go a little bit backwards before it starts to go forwards. If you over optimise when the market is shifting quickly, you can just make things worse.

Consider all Shopping Campaign Types, P.Max, Smart (at least until September!) and Standard Shopping. Whilst Google’s automated campaign types P.Max and Smart Shopping have delivered great results throughout the pandemic. Remember, that they automated and data-driven. Quick changes to buying habits can cause these campaigns to suffer until they can better understand and quantify the data.

Note: The data in the reports within this article are aggregated from 2,179 Google Ads accounts and they were correct at time of publishing: 24/03/2022

Monthly Subscription